Addressing the Current Shortage of Oil Tankers

The global demand for crude oil prices continues to rise, leading to an increased reliance on oil tankers to transport this valuable resource across the world. However, recent years have seen a significant shortage of available oil tankers, causing disruptions in the supply chain and impacting the global economy.

With the majority of oil transported by sea, this shortage has become a pressing issue for countries that heavily depend on oil imports. The lack of available tankers has led to higher shipping costs, longer delivery times, and concerns over oil supply security.

The current shortage of oil tankers is a result of a combination of factors, including increased oil production, aging tanker fleet, and stricter environmental regulations. As the world's population and economies continue to grow, the demand for a collective action for oil will only increase, making it crucial to address this shortage promptly.

In this article, we will explore the causes of the current shortage of oil tankers, its impact on the global economy, and potential solutions to address this pressing issue.

The Insufficient Number of Ships

The oil tanker industry has been issuing longstanding warnings about the insufficient number of ships being constructed, and now these concerns are materializing as Houthi attacks on commercial shipping lead to widespread disruptions in global petroleum trades.

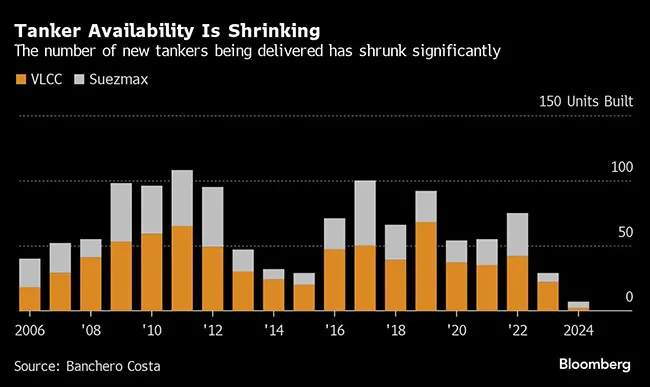

The addition of only two new supertankers to the fleet in 2024 marks the lowest level or the lowest number in nearly four decades, representing a decline of approximately 90% compared to the average annual additions in this millennium. As owners increasingly avoid the southern Red Sea, the lack of new capacity is beginning to have a tangible impact: rates are experiencing sudden spikes, and the duration of voyages is increasing.

Last year, rates remained stable due to OPEC and its allies limiting oil supply in the oil market. Concurrently, the wider global shift towards clean energy, renewable energy sources or alternative energy sources is expected to diminish the long-term prospects of the oil industry.

However, the growing avoidance of the southern Red Sea is exacerbating the already extended trade durations resulting from Russia's conflict in Ukraine.

Alexander Saverys, CEO of Euronav NV, one of the leading pure-play owners, highlighted the daily repercussions of these diversions on the shipping industry as a whole, particularly in crude oil and refined product tanker shipping, during an earnings call earlier this month. Coupled with the scarcity of new vessel deliveries and an aging fleet, the outlook for tankers appears highly promising.

Swiftly Altered Their Routes

Despite the Red Sea attacks commencing in November, it was primarily commercial vessels, particularly containerships, that swiftly altered their routes to avoid the area. On the other hand, oil and fuel tankers were slower in their response to steer clear of the region.

However, this changed recently when Yemen was targeted by U.S. and U.K. forces in an attempt to curb these incidents. Paradoxically, these military interventions failed to deter the Houthis and instead resulted in major tanker owners opting to keep their vessels away from the area.

Enrico Paglia, the research manager at Banchero Costa, a reputable shipping services firm, expressed concerns over the tight situation in the tanker market or energy market, especially for crude oil tankers, which is projected to worsen in the future.

The scarcity of tankers arises at a time when the global fleet's efficiency is declining. Notably, many vessels are now choosing to navigate around southern Africa rather than through the Red Sea and Suez Canal.

Additionally, the emergence of an expanding dark shadow fleet further restricts availability to select customers.

The shipping industry is renowned for its cyclical nature, experiencing periods of prosperity followed by downturns. During 2020, when oil traders resorted to storing excess oil on any available vessel, average earnings skyrocketed to approximately $100,000 per day.

However, subsequent production cuts enforced by the Organization of Petroleum Exporting Countries (OPEC) and its allies triggered a significant and prolonged decline.

A Multitude of Bullish Factors

Presently, a multitude of bullish factors are at play in the market. Following a reconfiguration of global oil flows in the wake of Russia's incursion into Ukraine, oil deliveries have predominantly transitioned to longer distances. Shipments to Europe, which once traversed the Baltic Sea in a matter of days, now require weeks to reach other regions across the globe.

Furthermore, the disruptions in the Red Sea have intensified the already protracted sailing times.

In light of these circumstances, vessel employment rates, a crucial indicator of the tanker fleet's utilization, have surged by up to 5%. Fotios Katsoulas, the lead analyst for tanker shipping at S&P Global Commodity Insights, affirms that the situation in the Red Sea is reshaping market fundamentals and favoring ship operators.

Consequently, the prevailing sentiment has considerably improved.

The optimistic outlook is further bolstered by the historically low order book. Banchero Costa's data reveals that, apart from the two supertankers slated to join the fleet this year, a mere five vessels are expected to be added by 2025. This stands in stark contrast to the 42 ships delivered in 2022.

However, it is crucial to exercise prudence amidst these developments. OPEC+ continues to curtail production in its efforts to prop up price of oil, thereby exerting downward pressure on the volume of oil in transit, which presently falls below last year's levels.

Additionally, elevated freight rates may naturally self-regulate by rendering longer distance voyages economically unviable, potentially dampening tanker demand in the long run.

Greater Profitability

Owners also demonstrate opportunistic behavior and may occasionally attempt to modify construction orders for new vessels that offer greater profitability. However, equity analysts predominantly hold a positive outlook towards tanker owners.

For instance, Frontline Plc, renowned as the world's largest publicly traded dedicated tanker owner, has garnered 12 buy recommendations from a total of 16 companies covering its operations. Similarly, International Seaways Inc., ranked among the top 10 owners, has received 11 buy recommendations from all of its 11 analysts.

Renowned industry expert Paglia from Banchero Costa asserts that due to factors such as a limited order book, a rapidly aging fleet, an abundance of overage tonnage, and the influence of environmental regulations within the sector, the prosperous market for tanker owners is expected to endure in the foreseeable future.

In Conclusion

The current shortage of oil tankers has sparked concern and urgency in the global market. However, as we have discussed, there are various factors contributing to this supply shortage and solutions are being implemented to address it.

It is crucial for energy companies, oil companies and shipping companies to work together and adapt to the changing market dynamics in order to ensure a stable and efficient transportation of oil. With careful planning and strategic investments, we can overcome this challenge and continue to meet the world's demand for oil.

It is important to stay informed and proactive in navigating this issue, and together, we can find solutions to secure a steady supply of oil for the future.

If you want to stay updated with a wide range of trends, actionable insights, and innovative solutions in the trucking, freight, and logistics industry, stay connected to us.

Moreover, If you are looking for more information about drug and alcohol testing as a truck driver, visit LabWorks USA.

Our DOT Consortium's friendly team will be more than happy to discuss any concerns you may have and work with you to ensure you are always fully compliant, especially with random DOT drug and alcohol testing. Moreover, if you need help with FMCSA Clearinghouse registration, we can further support you.