How Fleets and Suppliers Collaborate to Combat Fuel Card Skimming

In the ever-evolving world of transportation, fleet companies and their suppliers face numerous challenges in ensuring the security and efficiency of their operations. One of the common types or major concerns that plagues the industry is fuel card skimming, a form of fraud where criminals use illegal devices to capture and steal sensitive information from fuel cards.

This not only results in significant financial losses for both fleets and suppliers, but it also poses a risk to the safety and reputation of their businesses. In response to this threat, fleets and suppliers have come together to collaborate and implement strategies to combat fuel card skimming.

This collaboration involves a joint effort to establish comprehensive services, stronger security protocols, share information and resources, and continuously improve measures to prevent and detect fraud.

In this article, we will explore the current state of fuel card skimming in the transportation industry, the ways in which fleets and suppliers are working together to address this issue, and the impact of their collaboration on the future of fuel card security.

Considerable Challenges

Carriers face considerable challenges when it comes to incorporating legitimate fuel charges into their operational budgets, let alone combatting the increasing prevalence of fraudulent payments. Cybercriminals employ various tactics to deceive fleet drivers, including phishing schemes aimed at pilfering payment card PIN codes and identities.

However, one particular scam has proven to be both exceptionally daunting and financially onerous: fuel card skimming.

This fraudulent scheme entails the installation of devices at truck stop fuel pumps that masquerade as genuine card readers. These deceptive contraptions clandestinely capture the information from the payment card used by the truck driver.

Once obtained, the malefactors exploit the pilfered data to conduct their own unauthorized transactions, only ceasing when the fleet manager is alerted and deactivates the compromised card.

Hemant Banavar, Vice President of Financial Products at San Francisco-based company Motive, has highlighted that the lack of innovation in chip technology exacerbates this problem. "Certain cards currently available in the market lack the mechanisms to prevent skimming," he explains. "Some still rely on magnetic strips, devoid of the advanced security features offered by chip technology."

Exploiting scenarios in which drivers resort to magnetic strip fuel usage due to chip reader malfunctions or their absence, scammers can capitalize on this vulnerability. Banavar suggests that implementing a series of multifactor authentication measures, coupled with the imminent integration of artificial intelligence and machine learning technologies, can expedite the detection of anomalies that may indicate fraudulent activity.

Driver Frustration

In the realm of fleet management, the repercussions of card skimming scams can be significantly amplified, particularly when these fraudulent charges occur at gas pumps, which are frequently visited points of purchase. Once fraud is detected by the driver, the card is typically immediately locked, necessitating the dispatcher to arrange alternative payment methods, such as electronic funds sources, to ensure that the driver can continue their journey.

Milo Dubak, the CEO of Pure Freight Lines based in Chicago, unfortunately experienced the costly consequences of successful scammers. At its peak, fuel card skimming was transpiring on a weekly basis, resulting in fraudulent charges amounting to as much as $10,000 per month for the fleet.

Dubak explained, "In such instances, we have to cancel the fuel cards and diligently investigate the driver's movements and potential involvement in the fraud. Although uncomfortable, it is a necessary process that must be undertaken."

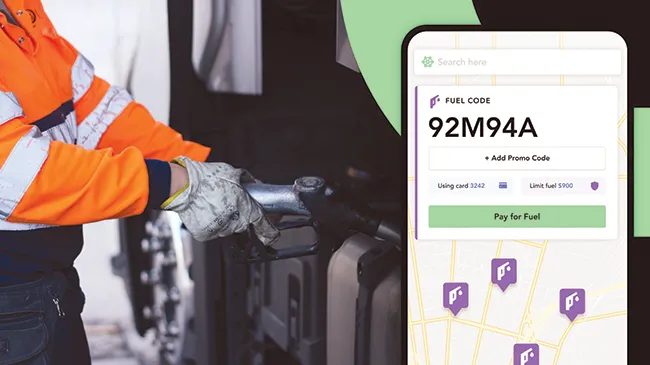

Spencer Barkoff, the President of Relay Payments, emphasized the importance of combating fuel card skimming by eliminating the physical cards altogether. One example of this is a system where drivers navigate through a series of security prompts and questions, then enter a code directly into the pump to purchase fuel at a previously agreed discounted rate.

Through integration with an electronic logging device, drivers can access a monitoring system that oversees the entire purchase process.

Barkoff explained that this method significantly reduces the opportunities for potential scammers while simultaneously propelling the trucking industry towards a more modern reality.

Relay Payments has collaborated with Pilot Flying J to spearhead the implementation of this system, which includes offering pre-negotiated discounts for drivers.

"We have assisted trucking companies ranging from small fleets with just ten trucks to larger fleets with 600 vehicles in completely eliminating their reliance on fuel cards and fleet checks," Barkoff stated.

For drivers who still utilize fuel cards, detecting a skimming device can be an intimidating challenge. Scammers often discreetly place these devices on top of the actual card reader, leaving the driver oblivious to their presence.

However, upon closer inspection, one may notice irregularities such as the device being slightly misaligned with the rest of the pump.

In addition to their primary functions, the majority of pumps are equipped with a protective layer of security tape enveloping the cabinet panel. However, it is imperative to bear in mind that even this precautionary measure cannot be considered foolproof.

Fraudsters possess the capability of procuring their own tape via online channels and subsequently substituting the broken tape once their skimming apparatus has been discreetly installed. A key indicator of the tape's authenticity lies in the presence of the fuel company's logo, which significantly enhances the probability of it being the original tape.

Conversely, the absence of such a logo should be met with caution and vigilance on the part of the consumer.

Finding Solutions

Evans Delivery, a container drayage carrier based in Schuylkill Haven, Pa, faced a significant challenge in 2021 with the rise of card skimming. This criminal activity became a daily nightmare for the company, resulting in substantial financial losses.

To combat this issue, Meghan McBride, the fleet's manager of business operations, had to dedicate her entire day to addressing fraudulent charges ranging from $30,000 to $60,000 every month.

The severity of the fraud problem was overwhelming for Evans Delivery, causing a constant need to replace cards and disrupting their operations. Despite working with WEX, a leading provider of payment card programs, the fleet still had to bear the administrative burden of managing these fraudulent charges.

WEX provided financial assistance by covering the expenses, but the company needed a more effective solution to eliminate these fraudulent purchases entirely.

Fortunately, in the summer of 2023, Evans Delivery found the answer they were seeking. WEX introduced a solution that, as stated by McBride, successfully eradicated all fraudulent transactions involving their fuel cards.

The Importance of Implementing

Karen Stroup, the chief digital officer for WEX, emphasized the importance of implementing a process that empowers fleet managers to control spending and support drivers while ensuring the security of fuel purchases across various transportation management system (TMS) platforms. Stroup emphasized the necessity for managers to have real-time visibility into their trucks' locations, ensuring that any discrepancies are promptly detected and rejected.

WEX's system also identified specific geographic hotspots where card skimming was prevalent. This level of detail allowed them to dispatch teams to inspect those specific fuel pumps for the presence of fraudulent devices, further enhancing their efforts to combat this criminal activity.

Thanks to WEX's comprehensive solution, Evans Delivery can now operate with confidence, knowing that their fuel card transactions are secure and protected from fraudulent charges. This breakthrough not only safeguards the company's financial well-being but also frees up valuable time and resources that can be better utilized to drive their business forward.

Initial Implementation

Upon the initial implementation of the system by Evans, drivers could only obtain a passcode by dialing a number displayed on the card. However, as the product developed, they were granted access to an application where they could log in using a default passcode, which often coincided with their payment card number.

Regrettably, issues arose during this process. Some drivers would only enter the last four digits of their card number, resulting in them being locked out of the system and requiring assistance from EFS via phone support.

Furthermore, fuel stations faced a learning curve when it came to utilizing the system. If a cashier needed to intervene during a purchase, additional time was spent on the phone with the cashier, guiding them to the specific information needed to complete the transaction.

Given the large number of drivers, Evans had to train them in phases. It was only after the entire implementation was completed that the problem of fuel card skimming was effectively eradicated. McBride proudly stated, "Since then, there has not been a single instance of fraud."

The audacity of illegally installing a device on a truck stop's fuel pump may be astounding, but the criminal act itself is swift and offers a rapid return on investment.

According to some estimates, a skimmer added to a pump can begin gathering card data from users within a mere 17 seconds.

Employing Various Measures

To combat such fraudulent schemes that combine physical tampering with digital tools, fintech firms are employing various measures, including the deployment of geofencing to deactivate compromised cards.

Additionally, Motive utilizes AI and machine learning to identify suspected skimming by detecting anomalies in tank levels. Banavar explained, "Fuel tank levels can be quite erratic. Fuel simply moves around in a tank, but we can accurately determine tank levels and discern if a transaction should be for 100 gallons, yet the driver records 120 gallons."

Motive's system is also capable of detecting instances when a card assigned to a driver, or a card that appears to be assigned to them, is being used for numerous transactions far from the vehicle's actual location.

Banavar elaborated, "If the location of the transaction is 100 miles away, or even just 1 mile away, from where it should be happening, we can ascertain that something is amiss. For example, if a transaction originates from a Love's in Oklahoma City, but we know the driver is currently in Texas."

Barkoff emphasized that fuel card skimming fraud imposes additional costs on fleets, ultimately taking a toll on their business operations.

"In the trucking industry, when faced with a $10,000 fraud claim, the trucking company must pay their bill and then engage in a lengthy process with their billing card company to determine if the fraud will be covered. In the meantime, the company experiences a cash flow gap. We have witnessed companies going out of business due to this issue."

In Conclusion

The collaboration between fleets and fuel suppliers is crucial in combating fuel card skimming. By implementing security measures and sharing information, both parties can work together to prevent potential losses and protect their businesses.

It is important for fleets to carefully choose their fuel suppliers and regularly monitor their fuel card transactions, while suppliers must stay vigilant and ensure their systems are secure. Together, through effective communication and cooperation, the industry can continue to combat fuel card skimming and maintain the integrity of fuel card usage.

If you want to stay updated with a wide range of trends, actionable insights, and innovative solutions in the trucking, freight, and logistics industry, stay connected to us.

Moreover, If you are looking for more information about drug and alcohol testing as a truck driver, visit LabWorks USA.

Our DOT Consortium's friendly team will be more than happy to discuss any concerns you may have and work with you to ensure you are always fully compliant, especially with random DOT drug and alcohol testing. Moreover, if you need help with FMCSA Clearinghouse registration, we can further support you.